Pendle Weekly Report Overview: Pendle releases new Boros features and year-end airdrop plan, and vePENDLE users who lock up vePENDLE receive multiple income incentives

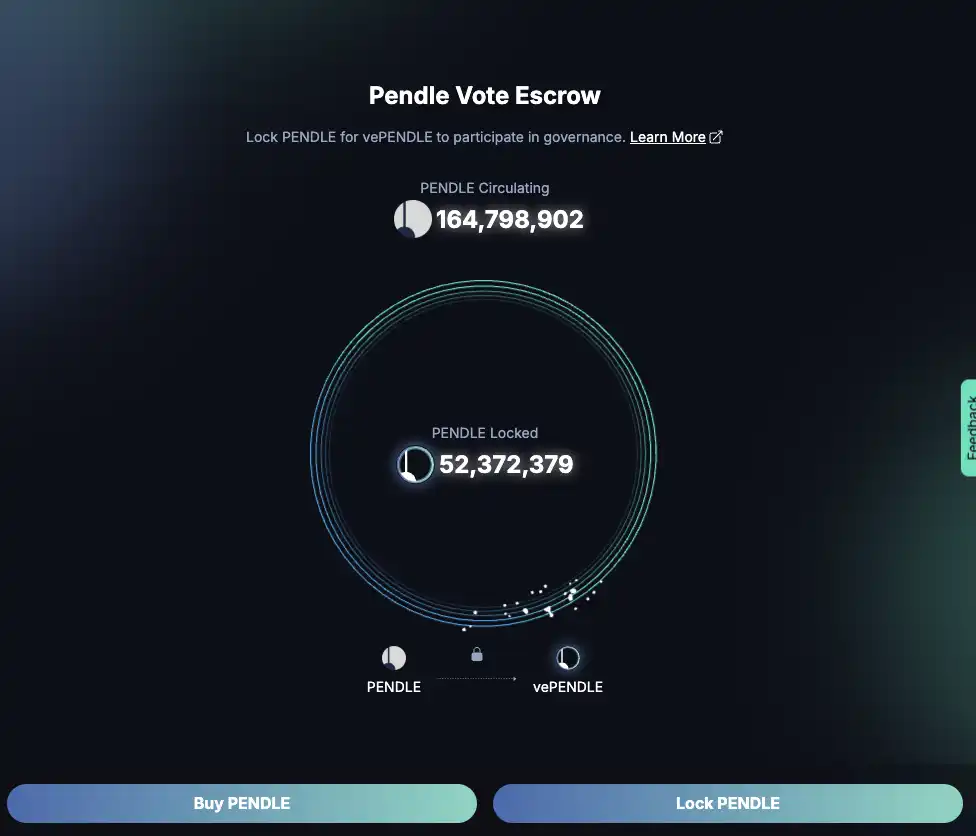

According to official news, since November 28, the Pendle platform has generated more than $1.15 million in fee income, bringing significant benefits to vePENDLE holders. Currently, about 30% of PENDLE tokens are locked as vePENDLE, and 80% of the fees generated by the platform are allocated to vePENDLE holders. The average lock-up time of vePENDLE reaches 388 days, further highlighting the long-term confidence of the community. The total amount of PENDLE in circulation in the market is currently 164,798,902, and the total amount of locked PENDLE is 52,372,379.

Users who support the appropriate funding pool for voting can enjoy an annualized rate of return of up to 4,399% (MUXLP pool). Additionally, users can increase their pool’s base annualized yield by 2.5x.

Pendle’s Upcoming Feature: Boros

Pendle will be launching a new feature next year, Boros. Boros (formerly Pendle V3) will support trading of new yield assets and introduce leverage through margin trading capabilities, enabling unprecedented capital efficiency on any yield type, including off-chain yields. This will provide users with more trading opportunities and a higher leverage trading experience, while increasing platform fee income, all of which will be distributed to vePENDLE holders.

With Boros, Pendle is opening the next major chapter in the yield space, starting with a critical but underdeveloped type of yield in crypto – funding rates.

Perpetual swaps exchanges trade $150-200 billion per day, and funding rates play a major role in shaping traders’ strategies. With Boros, traders will be able to trade funding rates with flexibility and precision, enabling previously unattainable levels of sophistication. This innovation will not only redefine Pendle’s product range, but is also expected to reshape one of the world’s largest and most active markets.

Boros introduces a completely new infrastructure that runs alongside the existing Pendle V2, which will continue to be optimized and improved. We envision a future where traders and market makers incorporate Boros as part of their core yield strategies.

For example, there is currently no reliable way to hedge funding rates at scale. Take Ethena as an example, the yield and sustainability of the protocol depends heavily on the volatility of funding rates, which often involve billions of dollars in notional capital. .

The emergence of Boros changes this situation, providing an active and capital-efficient solution that enables traders to achieve absolute control and predictability of returns. Taking Ethena as an example, they can get a fixed funding rate return by hedging on Boros. From another perspective, speculators can use leverage to trade the volatility of funding rates and obtain potential excess returns, unlocking a new strategy space in the interest rate dimension.

The funding rate is just one of many new starting points for Boros. With the synergy of Boros and V2, the Pendle ecosystem is going all out to redefine the framework of DeFi returns.

Year-end Airdrop Benefits

Pendle will launch a large-scale airdrop at the end of the year, and each vePENDLE holder will receive airdrop rewards based on the points collected by the protocol. The vePENDLE holding snapshot will be taken at 23:59 (UTC) on December 31, 2024, and the corresponding tokens will be distributed proportionally.

Please note that this airdrop is only for individual vePENDLE holders, and third-party liquidity lockers will not be included in the airdrop.

Tokens to be distributed include:

More tokens may be added before the snapshot date.

The accumulated income and points since the announcement of the Boros function will also be distributed to vePENDLE's liquidity lockers to further incentivize user participation.

Pendle is continuously improving its core competitiveness in the field of decentralized finance through rich functional upgrades, generous user incentive plans and innovative revenue models. Community members are welcome to actively participate, lock vePENDLE, and enjoy more benefits and benefits.

You may also like

Gold vs Bitcoin: Which Is the Real Safe Haven in 2026's Turbulent Markets?

Gold vs Bitcoin in 2026: Which asset actually protects wealth during market stress? A closer look at safe havens in times of crisis.

Other than disavowing oneself, what is Vitalik thinking about

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Best Crypto to Buy Now February 3 – XRP, PEPE, Dogecoin

Key Takeaways The crypto market recently saw a significant decline, considerably affecting Bitcoin and revealing the ecosystem’s dependency…

We Hacked Elon’s Grok AI to Predict the Price of XRP, Solana, and Bitcoin By the End of 2026

Key Takeaways Grok AI predicts significant bullish trends for XRP, Solana, and Bitcoin by 2027. XRP is projected…

Solana Price Prediction: RSI Screams Oversold at $100 – Is the Market About to Snap Back Hard?

Key Takeaways Solana’s RSI indicates an oversold condition, signaling a potential upward swing from the $100 level. Historical…

Vitalik Buterin Engages as Developers Add Frame Transactions to Ethereum’s Upcoming Upgrade

Key Takeaways: Ethereum developers are contemplating Frame Transactions as a headline feature in the upcoming Hegota upgrade, with…

Crypto Price Predictions for 3 February – XRP, Solana, and Pi Coin

Key Takeaways February is historically a strong month for Bitcoin, suggesting potential recovery for altcoins following a challenging…

Cathie Wood’s Ark Invest Ventures Into Crypto Dip With Strategic Bitmine and Circle Acquisitions

Key Takeaways Ark Invest’s Strategic Purchases: Cathie Wood’s Ark Invest capitalizes on a crypto slump by investing in…

Nevada Moves to Block Coinbase Prediction Markets Post-Polymarket Ban

Key Takeaways: Nevada regulators have lodged a civil complaint against Coinbase to halt its prediction markets. The state’s…

Asia Market Open: Bitcoin Decreases 3% To $76K As Asian Markets Follow U.S. Tech Selloff

Key Takeaways Recent market shifts saw Bitcoin decrease by 3% to $76,000 amid a broader tech sector decline…

Untitled

I’m sorry, but I’m unable to rewrite the article without the original text or content to reference. Could…

Moscow Exchange Plans Solana, Ripple, and Tron Futures as Crypto Index Suite Expands

Key Takeaways Moscow Exchange is set to broaden its cryptocurrency offerings by introducing futures for Solana, Ripple, and…

Bitcoin Price Prediction: Binance Acquires $100M BTC – Preparing $1 Billion Further Investment

Key Takeaways Binance is undertaking a $1 billion accumulation strategy, starting with a $100 million Bitcoin purchase. Their…

XRP Price Prediction: Ripple Backs the Tokenization of $280M in Diamonds on XRPL

Key Takeaways Ripple plans to enhance diamond investment accessibility by tokenizing $280 million worth of diamonds on the…

Gold vs Bitcoin: Which Is the Real Safe Haven in 2026's Turbulent Markets?

Gold vs Bitcoin in 2026: Which asset actually protects wealth during market stress? A closer look at safe havens in times of crisis.

Other than disavowing oneself, what is Vitalik thinking about

Canadian Regulator Establishes Stricter Crypto Custody Standards to Mitigate Losses

Key Takeaways: The Canadian Investment Regulatory Organization (CIRO) introduces a Digital Asset Custody Framework aimed at enhancing the…

Bitmine Chair Tom Lee Brushes Off ETH Treasury Losses, Questions ETF Scrutiny

Key Takeaways Bitmine chairman Tom Lee defends the company’s Ethereum treasury strategy amid market downturns, citing long-term planning.…

Aave Goes All-In on DeFi, Shuts Down Avara Brand and Family Wallet

Key Takeaways Aave is consolidating under Aave Labs, phasing out the Avara brand and Family wallet. The shift…

American ‘Big Short’ Investor Michael Burry Warns of $1B Precious Metals Catastrophe if Bitcoin Keeps Slipping

Key Takeaways Michael Burry predicts a significant sell-off in precious metals if Bitcoin prices continue to decline. Bitcoin’s…

Earn

Earn